Sound like good news?

Diving into a creative economy research report from the CVSuite™ can be like opening a Christmas present. Surprise: Media jobs have grown 5% from the previous year, and three-year trends show steady upward growth! Hooray: Job growth in creative industries is on the rise and wages are going up! Oh, you shouldn’t have: Nonprofit cultural organizations are showing steady gains in earned-income revenues! Everybody loves the gift of good news.

But what about bad news?

Any study of the creative economy that only reports good news shouldn’t be trusted. Think about it like this: Would you trust a doctor who always tells you that you’re in top shape, even when you know you’re not feeling well? Probably not. The health of economies, creative or otherwise, fluctuates in a manner similar to personal health. Just like no one lives in perpetually good health, no economic sector perpetually grows–not even behemoths like agriculture, manufacturing, and, recently, technology. To assume that the creative economy is immune to “bad news” is to deny the truth. Beware of quacky creative economy research reports where all the bad news has been suppressed.

The Whole Story

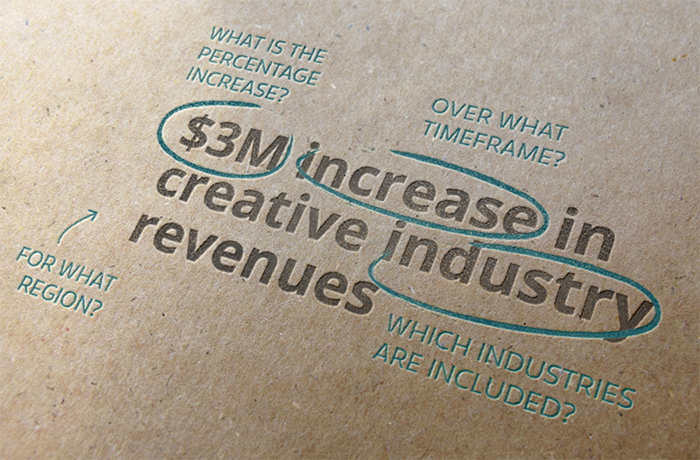

The truth about creative economies–and about interpreting creative economy research–is that there is never really good news or bad news. There are only indicators of economic activity that can be interpreted as signs of the flourishing or failing health of a region’s creative economy. Let’s look at some examples of indicators that can be interpreted multiple ways:

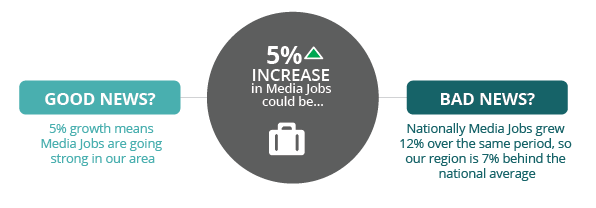

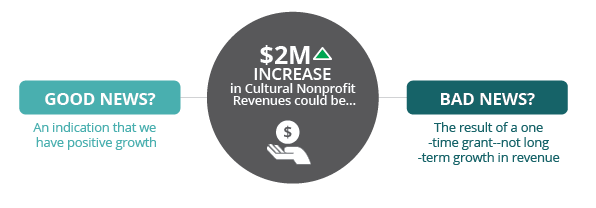

5% growth in Media Jobs A region’s 5% growth in media jobs may reflect a vibrant sector; however, it could just as well reflect sector under performance. Comparing a region to surrounding regions or to the national average may reveal that a 5% growth in media jobs is less than the growth happening outside of the region.  $2 million increase in Cultural Nonprofit Revenues A $2 million increase in cultural nonprofit revenues from one year to the next reflects positive growth in quantitative terms. However this type of growth may not characterize growth for the entire sector of a region. For example, a one-time gift to a single nonprofit organization would indicate only temporary growth within a small subset of nonprofit organizations.

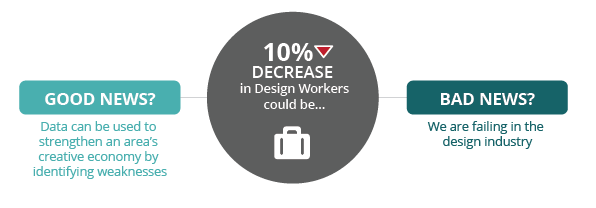

$2 million increase in Cultural Nonprofit Revenues A $2 million increase in cultural nonprofit revenues from one year to the next reflects positive growth in quantitative terms. However this type of growth may not characterize growth for the entire sector of a region. For example, a one-time gift to a single nonprofit organization would indicate only temporary growth within a small subset of nonprofit organizations.  10% decrease in design workers A 10% decrease in design workers–superficially viewed as bad news–could be just the statistic needed to convince funders or elected officials of the importance of an initiative to create a nationally competitive design sector. Job loss can be a call to action, not a woeful discovery.

10% decrease in design workers A 10% decrease in design workers–superficially viewed as bad news–could be just the statistic needed to convince funders or elected officials of the importance of an initiative to create a nationally competitive design sector. Job loss can be a call to action, not a woeful discovery.  As we discussed in our Putting Data to Work post, getting to the truth about your CVSuite™ data requires interpretive effort. By beginning with the assumption that CVSuite™ reports are diagnostic tools, users can understand the strengths and challenges of their creative economies. From this perspective, the good news about your creative economy will be the result of what you do with the data.

As we discussed in our Putting Data to Work post, getting to the truth about your CVSuite™ data requires interpretive effort. By beginning with the assumption that CVSuite™ reports are diagnostic tools, users can understand the strengths and challenges of their creative economies. From this perspective, the good news about your creative economy will be the result of what you do with the data.

Comments are closed.